The Debt to Assets Ratio Best Answers Which Financial Question

A high debt ratio indicates that a corporation has a high level of financial leverage. Shows farm liabilities relative to farms assets.

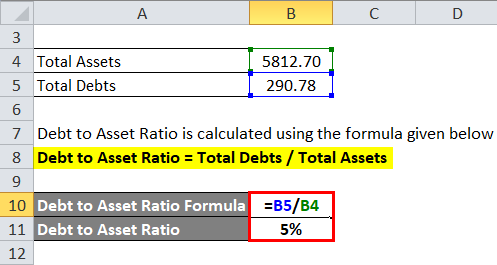

Debt To Asset Ratio Formula Calculator Excel Template

Equity 567500 Reserve surplus 387850 total debt 588778 out of which 288778 Eire long term debt fixed assets are 1144128Current Ratio.

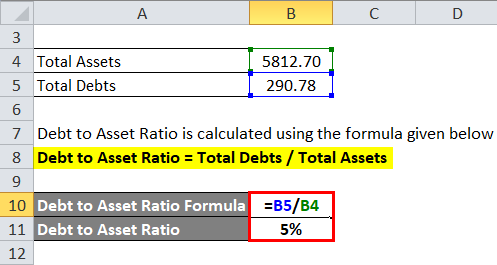

. Often the debt ratio is computed as total debt both current and long-term divided by total assets. Calculate the companys debt-to-equity ratio. Total assets Non-current assets Tangible Intangible assets long-term loans and advances Non-current investments Current assets Trade receivables Cash and Cash equivalents Short-term loans and advances other current assets.

Whether interest can be paid on debt in the current year. What Is The Debt To Total Assets Ratio. In general many investors look for a company to have a debt ratio between 03 and 06.

Therefore the figure indicates that 22 of the companys assets are funded via debt. So with Company XYZ we would look at 814 million in total liabilities divided by 2000 in total assets. Debt ratio profit margin total asset turnover financial leverage.

The debt ratio indicates the percentage of the total asset amounts stated on the balance sheet that is owed to creditors. From a pure risk perspective debt ratios of 04 or lower are considered better while a. Boulder Mountain Ski Company has total assets of 497000000 and a debt ratio of 029.

Operating ratios COGS Operating expensesNet sales. Operating profit ratio 1 operating ratio. Debt to Asset Ratio 50000 226376 02208 22.

Thus if a company has 50000 in debt and assets of. The debt-to-asset ratio also known simply as the debt ratio describes how much of a companys assets are financed by borrowed money. The proportion of interest paid relative to dividends paid.

Total assets to debt ratio Total assets Debt. The formula for calculating the debt-to-asset ratio for your business is. The higher the debt-to-asset ratio the more money creditors have in the business relative to the owner and the higher financial risk the farm business faces.

It tells you the percentage of total assets that were financed by creditors liabilities debt. Sales Asset Turnover Php 15000000 30x Debt to Equity Ratio Weighted average outstanding shares 15 200000 shares Asset turnover only considered asset balance as of December 31. This tells you that 407 of your firm is financed by debt financing and 593 of your firms assets are financed by your investors or by equity financing.

The debt to total assets ratio is an indicator of financial leverage. It is expressed as pure ratio 21. Thus if a company has 50000 in.

Interpretation of Debt to Asset Ratio. Debt-to-Assets 814 2000 407. These assessments will help you test your understanding of contributing factors to debt ratio.

The debt to asset ratio is commonly used by analysts investors and creditors to determine the overall risk of a company. A 248 B 192. The DuPont Analysis uses the following ratios except.

How to calculate the debt-to-asset ratio for your small business. Current ratio working capital cash ratio debt to assets ratio. The following information are related to Bacon Corporation.

Total assets to debt ratio Total assets debts. If a company has a total-debt-to-total-assets ratio of 04 40 of its assets are financed by creditors and 60 are financed by owners shareholders equity. Which of the following has the best debt-to-asset ratio.

Practice understanding debt ratio with this multiple choice quizworksheet combo. Therefore the debt to asset ratio is calculated as follows. Test your knowledge of the financial ratios with multiple choice questions and quizzes.

And Wal-Mart Stores Inc. In general a debt-to-asset ratio below 050 is desirable. Investors consider it among other factors to determine the strength of the business and lenders may base loan interest rates on.

Boulder Mountain Ski Company has total assets of. Answer C fred has total assets of 36000 and total de. The debt to total assets ratio is calculated by dividing a corporations total liabilities by its total assets.

How much is the book value per share of Bacon Corporation based on the foregoing information. The percentage of the total assets provided by creditors. The best ratio to evaluate short-term liquidity is.

View the full answer. The debt to assets ratio measures a. Capital employed Total of fixed assets Working capital.

Often the debt ratio is computed as total debt both current and long-term divided by total assets. O Maria has a monthly income of 8000 and expenses of 6000 O Cassandra has a monthly income of 2000 and expenses of 1200 O Fred has total assets of 36 000 and total debt of 23 000. Net profit ratio is calculated by dividing net profit after interest and tax by net sales.

What Is The Debt To Total Assets Ratio Online Accounting

No comments for "The Debt to Assets Ratio Best Answers Which Financial Question"

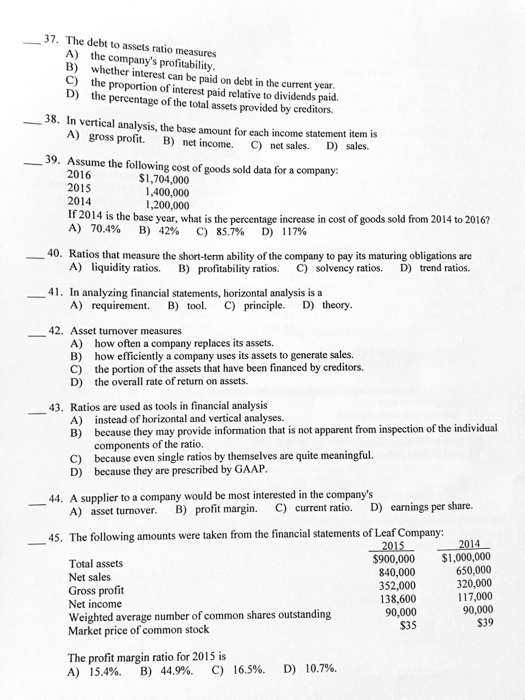

Post a Comment